Global Petcare Market Trends: Toward a Decade of Sustainable Expansion

The global pet care sector is entering a new phase of sustained growth. The combination of new consumer habits, preventative healthcare, and emerging markets is consolidating an economy that could exceed $500 billion by 2030

Overview: Stable Growth and New Drivers

The global market for pet products and services continues to grow. According to Bloomberg Intelligence estimates (2024), the industry could grow between 5% and 6% annually, reaching around $380 billion by 2025.

The expansion is driven by two key factors: the strengthening of emerging markets and the development of new lines of animal health and well-being.

The trend toward "humanizing" pets, along with increased purchasing power and the digitalization of retail, will allow the sector to surpass $500 billion by 2030, consolidating its position as one of the most dynamic consumer economies in the world.

USA and Europe: The Maturity of the Premium Market.

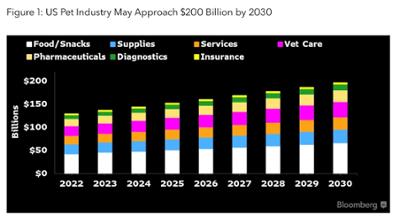

The United States continues to be the epicenter of the global business, accounting for nearly 40% of global sales.

Forecasts indicate that spending on pet products and services in the country will exceed $150 billion in 2025 and approach $200 billion in 2030.

Europe, meanwhile, remains the second largest bloc, with an estimated value of $131 billion in 2025 and a projection of $165 billion by 2030.

Asia and China: Sustained Growth and Cultural Change

The Asian market, led by China, is advancing rapidly. The Chinese sector is expected to grow by 6.6% annually, reaching $37 billion by 2025 and representing 10% of the global market by 2030.

Factors such as urbanization, digitalization, and restrictions on dog ownership in some cities are driving the preference for cats as domestic pets.

Beyond China, other Southeast Asian economies are beginning to show a similar pattern: increased adoption, booming local products, and a young middle class that incorporates pet care as part of their lifestyle.

Food and health: the pillars of spending

Pet food remains the main driver of the sector.

Forecasts estimate the market value at over $110 billion in 2025 and $146 billion in 2030, with premium and functional products playing a particular role.

Consumers are increasingly seeking natural ingredients, balanced formulas, and measurable benefits for digestive, joint, and dermatological health.

In the US, "super premium" lines are growing at rates of 20–25% annually, reflecting a strong willingness to spend on the part of conscious consumers.

The snack segment continues to expand, albeit with more moderate growth, while the preventive health area—antiparasitics, supplements, and oral hygiene products—is gaining importance as a recurring expense.

Latin America: The New Focus of Opportunity

The Latin American region is positioned as one of the most promising expansion hubs for the next decade.

The regional pet care market already exceeds $11.4 billion (2024) and could maintain average annual growth of 5.8% until 2033, according to IMARC Group (2025).

- Brazil leads the ranking with R$75.4 billion in 2024 (+9.6%), with food accounting for 54% of the total business. (ABINPET, 2025)

- Mexico, the second-largest market in terms of volume, will reach $3.5 billion in 2025 and is projected to reach $4.9 billion in 2030. (PetFoodIndustry, 2025)

- Other countries such as Chile, Colombia, and Peru are experiencing accelerated growth, driven by specialized retail and the entry of international brands.

The most visible trends in the region are:

- democratization of the premium segment (higher-value products at competitive prices),

- the rise of specialized e-commerce,

- the increase in households with cats,

- and the consolidation of preventive healthcare as a high-growth category.

According to Euromonitor International (2025), Latin America will grow above the global average and could represent more than 8% of the global market by 2030, with Brazil and Mexico as key players.

A Strategic Overview: What It Means for Spain and Europe

For the Spanish business community, this context opens up three major avenues of opportunity:

- Selective internationalization:

Export to emerging markets where the pet-friendly category is developing, especially in Latin America.

- Functional and sustainable innovation:

Invest in foods and products with scientific evidence, traceability, and natural ingredients.

- Strategic alliances with local distributors:

Combine European credibility with the regional reach of established trading partners.

The immediate challenge will be to balance maturity in the European market with smart expansion into geographies with greater potential, while maintaining the identity and quality of Spanish products as a distinguishing feature.

Sources: Bloomberg Intelligence (Global Pet Economy 2024), GlobalPETS, ABINPET (2025), IMARC Group (2025), PetFoodIndustry (2025), Euromonitor International (2025).