Three keys to boosting heat pumps in Europe, according to the EHPA report

To achieve higher penetration for heat pumps, we must improve the competitiveness of electricity prices, establish stable and long-lasting support programmes, and strengthen the training of installers, to make this technology more accessible to consumers. This is according to the latest analysis of the European Heat Pump Association (EHPA), whose CEO, Paul Kenny, highlights the strategic value of heat pump systems.

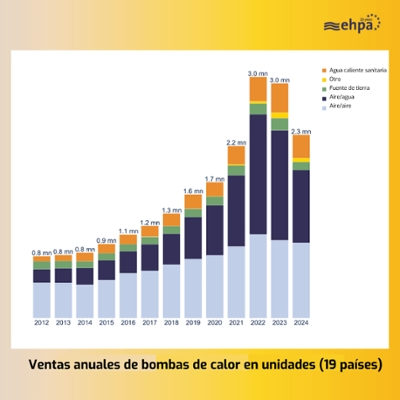

The numbers of heat pumps installed in Europe in proportion to population show marked differences across different countries, as revealed by the latest report of the European Heat Pump Association (EHPA). The data reveal the large margin for growth that still exists in many markets, including the Spanish market. During the presentation of the report, EHPA CEO Paul Kenny highlighted the strategic value of this technology: every heat pump that replaces a gas or oil boiler reduces dependency on fossil fuels, strengthens Europe's energy security and cuts emissions.

The analysis shows that in order to achieve a higher penetration of heat pumps, we must improve the competitiveness of electricity prices, establish stable and long-lasting support programmes, and strengthen the training of installers, to make this technology more accessible to consumers.

The report's focus on air-to-water pumps for heating only, and on the number of units sold per 1,000 households, shows Norway topping the list with 632 pumps installed per 1,000 households, followed by Finland with 524. In 2024, Norway sold 48 units per 1,000 households and Finland 33, compared to 3.5 in the UK.

The Association of Air Conditioning Equipment Manufacturers (AFEC) reminds us to interpret these figures within the assumptions applied. So although the UK market is positioned towards the bottom of the list, it was one of the few markets that grew last year, along with Ireland and Portugal, thanks to stable support programmes.

Conditions in Norway and Finland favour a faster roll-out: their pumps are not reversible (heating and hot water only), they have no gas infrastructure for heating and rely on an extensive electricity grid. This makes the technology less complex, with lower manufacturing costs, making it easier to achieve good SCOP, leaving the option of electrifying thermal demand virtually the only option. However, their net contribution to the EU decarbonisation target is small, as they are limited to heating and these countries have relatively small populations.

Positive developments in Spain

In Spain, despite an extensive gas grid, historically favourable fossil fuel prices, high summer cooling demand and more stringent regulatory requirements to justify renewable heat and cooling, the heat pump is making steady and resilient progress, and its contribution in net terms to the decarbonisation pursued by Europe is significant. According to IDAE and Eurostat data, in 2023 there were almost 6 million heat pumps in stock and an installed capacity of 40.9 GW.

As a member of EHPA and its board of directors, AFEC welcomes this report, which reinforces the importance of continuing to promote the deployment of heat pumps as a key solution to meet European targets for decarbonisation, energy efficiency and household well-being.